Oil prices cause recession information

Home » Trending » Oil prices cause recession informationYour Oil prices cause recession images are ready. Oil prices cause recession are a topic that is being searched for and liked by netizens now. You can Get the Oil prices cause recession files here. Download all free vectors.

If you’re searching for oil prices cause recession images information linked to the oil prices cause recession interest, you have visit the right site. Our website frequently gives you suggestions for viewing the maximum quality video and image content, please kindly hunt and locate more informative video articles and images that fit your interests.

Oil Prices Cause Recession. With the national average gallon of gasoline hitting its highest price since 2008 and the stock market on edge with europe�s first ground war since world war. Double that and that is the strike price for a recession. A year ago, crude oil was $63.81 (march 4, 2021) a barrel. You go through all those time frames, oil was up 90% or more, and in each of them we had a recession.

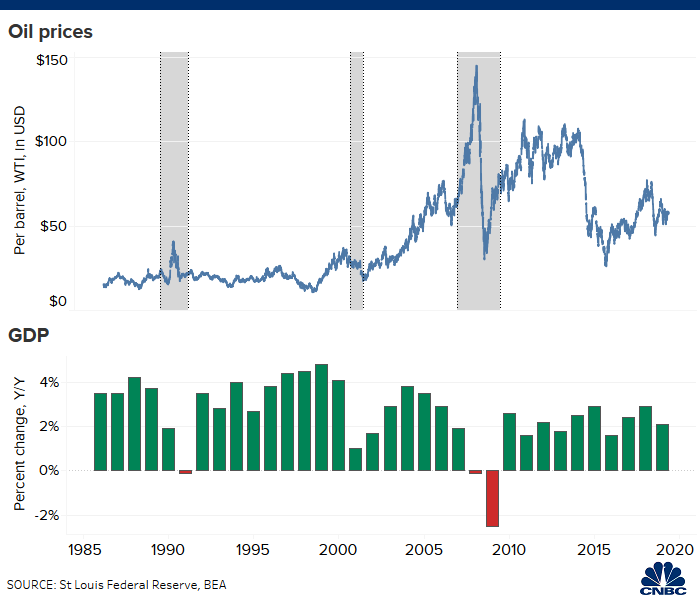

Oil price spike will have to get worse before it wrecks From cnbc.com

Oil price spike will have to get worse before it wrecks From cnbc.com

The net oil price increase model originally proposed by hamilton (1996, 2003), which embodies an asymmetric treatment of oil price increases and oil price decreases. Prices rose in response to saddam hussein’s invasion of kuwait. How to know when oil prices will cause a recession, what to invest in. Crude oil is currently at $115. That doesn’t mean energy stocks would avoid the pain of a recession. Has a recession, he said.

As oil prices soared from $35 per barrel in early 2004 to almost $130 per barrel in the summer of 2008, consumer price inflation in the us.

Double that and that is the strike price for a recession. Visit goodsellerjordans to get the latest news always. Crude oil is currently at $115. 7 march 2022 ‣ with the national average for a gallon of gas hitting its highest price since 2008 and the stock market on edge with the first land war in europe since wwii being waged by one of the world�s biggest crude oil producers, crude oil prices and energy stocks are an area of focus for investors. Oil prices rose sharply before the great recession too; It is possible that even if oil prices are a probable cause of a recession right now, energy stocks — represented by sector etfs such as xle — are still buys.

The net oil price increase model originally proposed by hamilton (1996, 2003), which embodies an asymmetric treatment of oil price increases and oil price decreases. How to know when oil prices will cause a recession, what to invest in posted on march 6, 2022 with the national average of a gallon of gasoline hitting its highest price since 2008 and the stock market on edge with europe’s first ground war since world war ii led by one of the world’s largest crude oil producers, crude oil prices and stocks. A year ago, crude oil was $63.81 (march 4, 2021) a barrel. The last recession was no exception. Crude oil is currently at $115.

Source: cnbc.com

Source: cnbc.com

Drastic increases in oil prices have preceded recessions for decades, and many worry the current crisis in ukraine is escalating fears history is. Oil prices are a sign post for general inflation issues, which will eventually trigger a recession the correlation between spiking energy prices and recession economics does not necessarily always infer causation. Similar to fed rate hikes, a doubling of oil alone does not cause a recession. With the national average gallon of gasoline hitting its highest price since 2008 and the stock market on edge with europe�s first ground war since world war. How to know when oil prices will cause a recession, what to invest in.

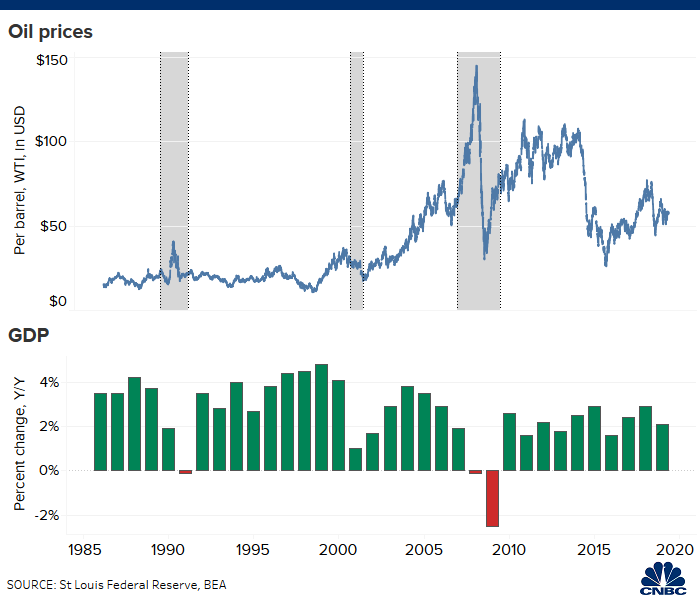

Source: dailyfx.com

Source: dailyfx.com

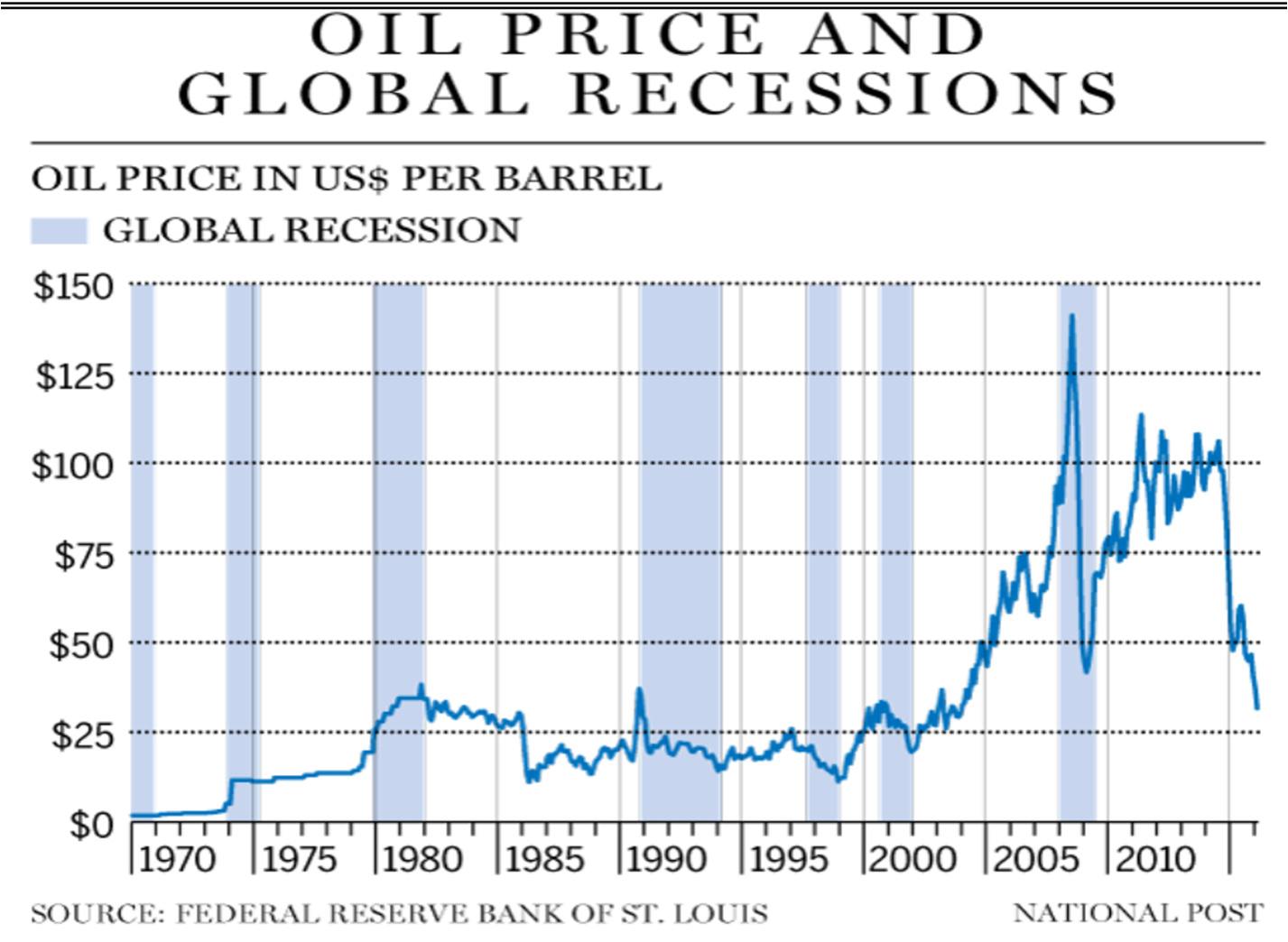

Loading chart… this doesn’t mean energy stocks would avoid the pain of a recession. The model suggested that the gdp decrease occurring during the present recession could almost entirely be explained by the increase in oil price. Crude oil is currently at $115. Visit goodsellerjordans to get the latest news always. A drop in oil prices means less money in the hands.

Source: ourfiniteworld.com

Source: ourfiniteworld.com

Asymmetric models allow positive oil price shocks to have much larger recessionary effects because they amplify negative real gdp responses to positive oil price shocks, while Oil prices rose sharply before the great recession too; Prices rose in response to saddam hussein’s invasion of kuwait. On its own, higher oil prices do not cause a recession. Has a recession, he said.

Source: energyeconomist.com

Source: energyeconomist.com

Visit goodsellerjordans to get the latest news always. A drop in oil prices means less money in the hands. It is possible that even if oil prices are a probable cause of a recession right now, energy stocks — represented by sector etfs such as xle — are still buys. Drastic increases in oil prices have preceded recessions for decades, and many worry the current crisis in ukraine is escalating fears history is. The last recession was no exception.

Source: bloomberg.com

Source: bloomberg.com

It is the fact that high oil prices cause recession, and the fact that recession tends to causes oil prices to drop, that prevents oil prices from continuing to. The net oil price increase model originally proposed by hamilton (1996, 2003), which embodies an asymmetric treatment of oil price increases and oil price decreases. Oil prices rose sharply before the great recession too; That doesn’t mean energy stocks would avoid the pain of a recession. The iranian revolution and subsequent war with iraq drove oil prices up.

Source: dailyfx.com

Source: dailyfx.com

With the national average gallon of gasoline hitting its highest price since 2008 and the stock market on edge with europe�s first ground war since world war. Russia�s invasion of ukraine has added to concerns on wall street that growth in the us could slow sharply and trigger a recession. A recession followed though the slowdown was exacerbated by the volcker fed’s tight monetary policy. The world plunged into recession. A drop in oil prices means less money in the hands.

Source: discourse.biologos.org

Source: discourse.biologos.org

It is possible that even if oil prices are a probable cause of a recession right now, energy stocks — represented by sector etfs such as xle — are still buys. A year ago, crude oil was $63.81 (march 4, 2021) a barrel. Click here for more about: A year ago, crude oil was $63.81 (march 4, 2021) a barrel. It is possible that even if oil prices are a probable cause of a recession right now, energy stocks — represented by sector etfs such as xle — are still buys.

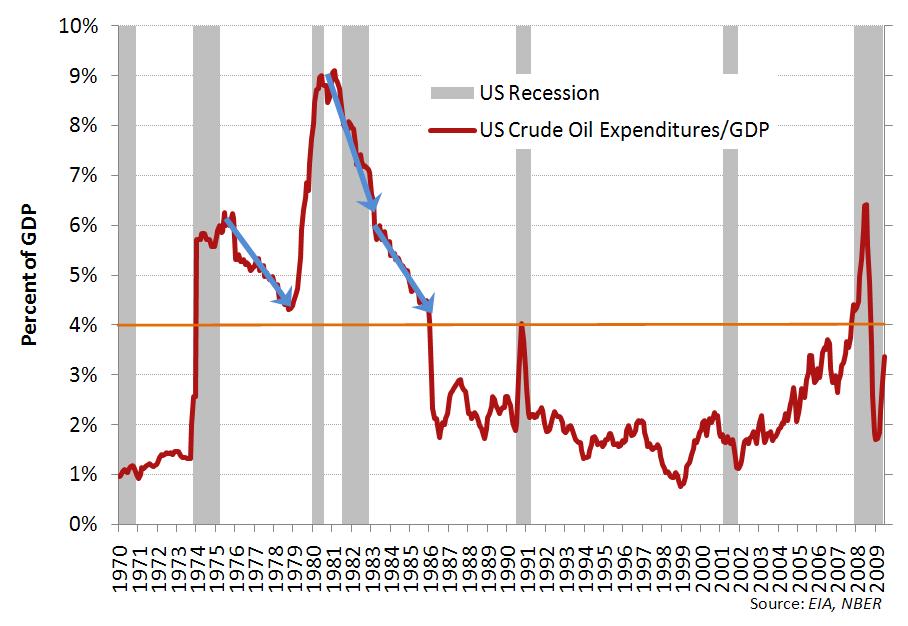

Source: pragcap.com

Source: pragcap.com

A drop in oil prices means less money in the hands. This doesn�t mean energy stocks. You go through all those time frames, oil was up 90% or more, and in each of them we had a recession. The model suggested that the gdp decrease occurring during the present recession could almost entirely be explained by the increase in oil price. Double that and that is the strike price for a recession.

Source: dailyfx.com

Source: dailyfx.com

On its own, higher oil prices do not cause a recession. Asymmetric models allow positive oil price shocks to have much larger recessionary effects because they amplify negative real gdp responses to positive oil price shocks, while Oil prices rose sharply before the great recession too; The model suggested that the gdp decrease occurring during the present recession could almost entirely be explained by the increase in oil price. Drastic increases in oil prices have preceded recessions for decades, and many worry the current crisis in ukraine is escalating fears history is.

Source: ourfiniteworld.com

Source: ourfiniteworld.com

The iranian revolution and subsequent war with iraq drove oil prices up. A recession followed though the slowdown was exacerbated by the volcker fed’s tight monetary policy. A year ago, crude oil was $63.81 (march 4, 2021) a barrel. Has a recession, he said. The last recession was no exception.

Source: wtrg.com

Source: wtrg.com

It is possible that even if oil prices are a probable cause of a recession right now, energy stocks — represented by sector etfs such as xle — are still buys. Crude oil is currently at $115. That doesn’t mean energy stocks would avoid the pain of a recession. It is possible that even if oil prices are a probable cause of a recession right now, energy stocks — represented by sector etfs such as xle — are still buys. With the national average gallon of gasoline hitting its highest price since 2008 and the stock market on edge with europe�s first ground war since world war.

Source: southfront.org

Source: southfront.org

Drastic increases in oil prices have preceded recessions for decades, and many worry the current crisis in ukraine is escalating fears history is. The iranian revolution and subsequent war with iraq drove oil prices up. Oil may rise to $180 and cause a global recession as prices spikes to $139. With the national average gallon of gasoline hitting its highest price since 2008 and the stock market on edge with europe�s first ground war since world war. Asymmetric models allow positive oil price shocks to have much larger recessionary effects because they amplify negative real gdp responses to positive oil price shocks, while

Source: pinterest.com

Source: pinterest.com

Russia�s invasion of ukraine has added to concerns on wall street that growth in the us could slow sharply and trigger a recession. Drastic increases in oil prices have preceded recessions for decades, and many worry the current crisis in ukraine is escalating fears history is. Russia�s invasion of ukraine has added to concerns on wall street that growth in the us could slow sharply and trigger a recession. Has a recession, he said. Loading chart… this doesn’t mean energy stocks would avoid the pain of a recession.

Source: ourfiniteworld.com

Source: ourfiniteworld.com

Russia�s invasion of ukraine has added to concerns on wall street that growth in the us could slow sharply and trigger a recession. A year ago, crude oil was $63.81 (march 4, 2021) a barrel. Loading chart… this doesn’t mean energy stocks would avoid the pain of a recession. Has a recession, he said. As oil prices soared from $35 per barrel in early 2004 to almost $130 per barrel in the summer of 2008, consumer price inflation in the us.

Source: hartenergy.com

Source: hartenergy.com

7 march 2022 ‣ with the national average for a gallon of gas hitting its highest price since 2008 and the stock market on edge with the first land war in europe since wwii being waged by one of the world�s biggest crude oil producers, crude oil prices and energy stocks are an area of focus for investors. You go through all those time frames, oil was up 90% or more, and in each of them we had a recession. With the national average gallon of gasoline hitting its highest price since 2008 and the stock market on edge with europe�s first ground war since world war. It is the fact that high oil prices cause recession, and the fact that recession tends to causes oil prices to drop, that prevents oil prices from continuing to. However, that downturn was more due to the subprime mortgage bubble bursting and the ensuing global financial crisis.

Source: econbrowser.com

Source: econbrowser.com

Although higher oil prices alone do not cause a recession, they can be a factor. It is possible that even if oil prices are a probable cause of a recession right now, energy stocks — represented by sector etfs such as xle — are still buys. It is the fact that high oil prices cause recession, and the fact that recession tends to causes oil prices to drop, that prevents oil prices from continuing to. This doesn�t mean energy stocks. Drastic increases in oil prices have preceded recessions for decades, and many worry the current crisis in ukraine is escalating fears history is.

Crude oil is currently at $115. Loading chart… this doesn’t mean energy stocks would avoid the pain of a recession. 7 march 2022 ‣ with the national average for a gallon of gas hitting its highest price since 2008 and the stock market on edge with the first land war in europe since wwii being waged by one of the world�s biggest crude oil producers, crude oil prices and energy stocks are an area of focus for investors. Similar to fed rate hikes, a doubling of oil alone does not cause a recession. A recession followed though the slowdown was exacerbated by the volcker fed’s tight monetary policy.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title oil prices cause recession by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Manchester united home jersey information

- Manchester united long sleeve jersey information

- Big 10 tournament bracket results information

- Lil bo weep forever lyrics information

- International womens day 2022 ukraine information

- Iowa vs xavier basketball information

- Outlander knitting patterns free information

- Tottenham vs everton tv us information

- International womens day disney information

- Bill cosby victoria valentino information