Interest rates vs oil prices chart information

Home » Trend » Interest rates vs oil prices chart informationYour Interest rates vs oil prices chart images are ready. Interest rates vs oil prices chart are a topic that is being searched for and liked by netizens now. You can Find and Download the Interest rates vs oil prices chart files here. Download all royalty-free images.

If you’re searching for interest rates vs oil prices chart images information connected with to the interest rates vs oil prices chart topic, you have come to the ideal site. Our site frequently provides you with hints for seeking the highest quality video and picture content, please kindly surf and locate more informative video content and graphics that fit your interests.

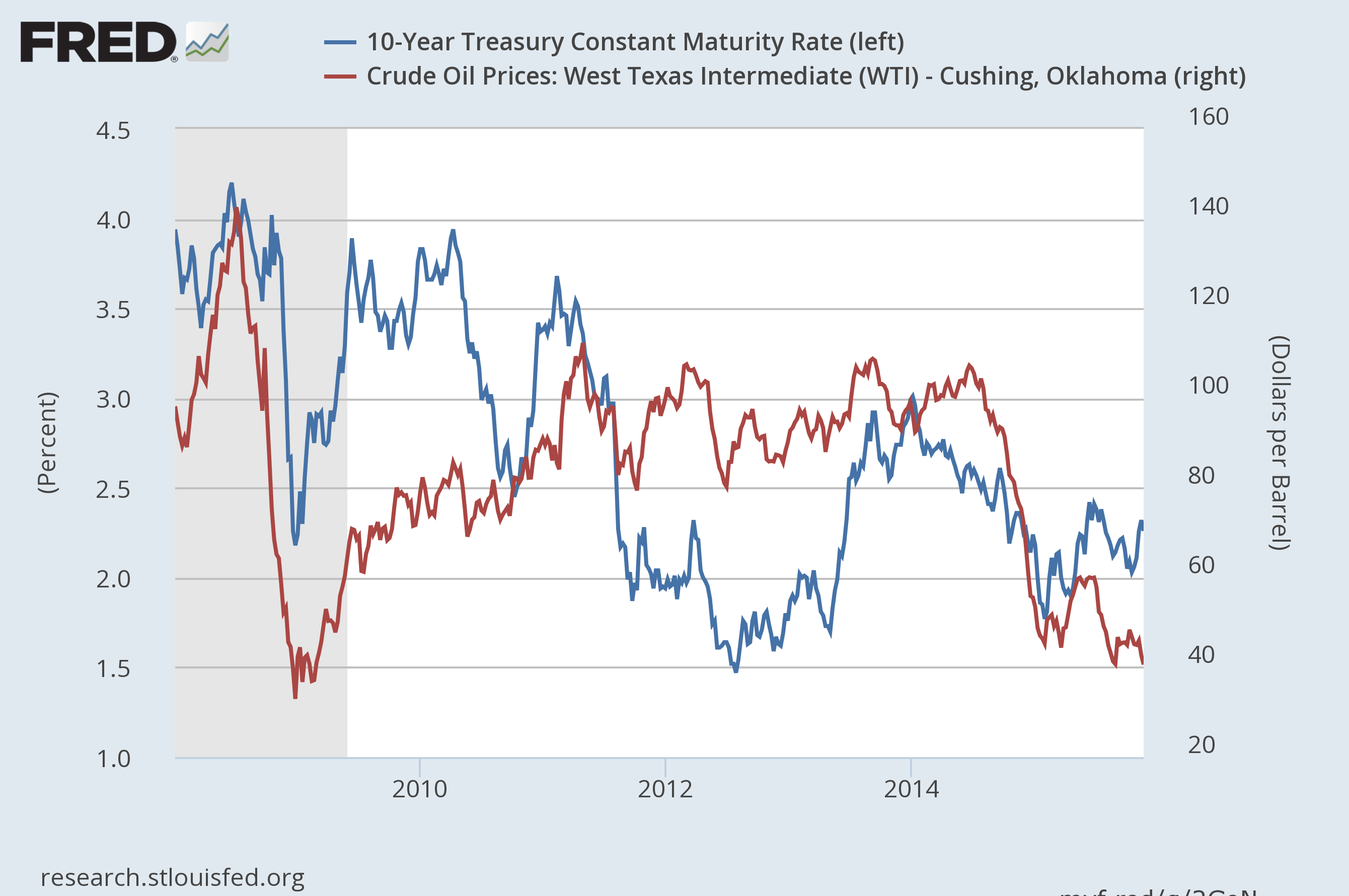

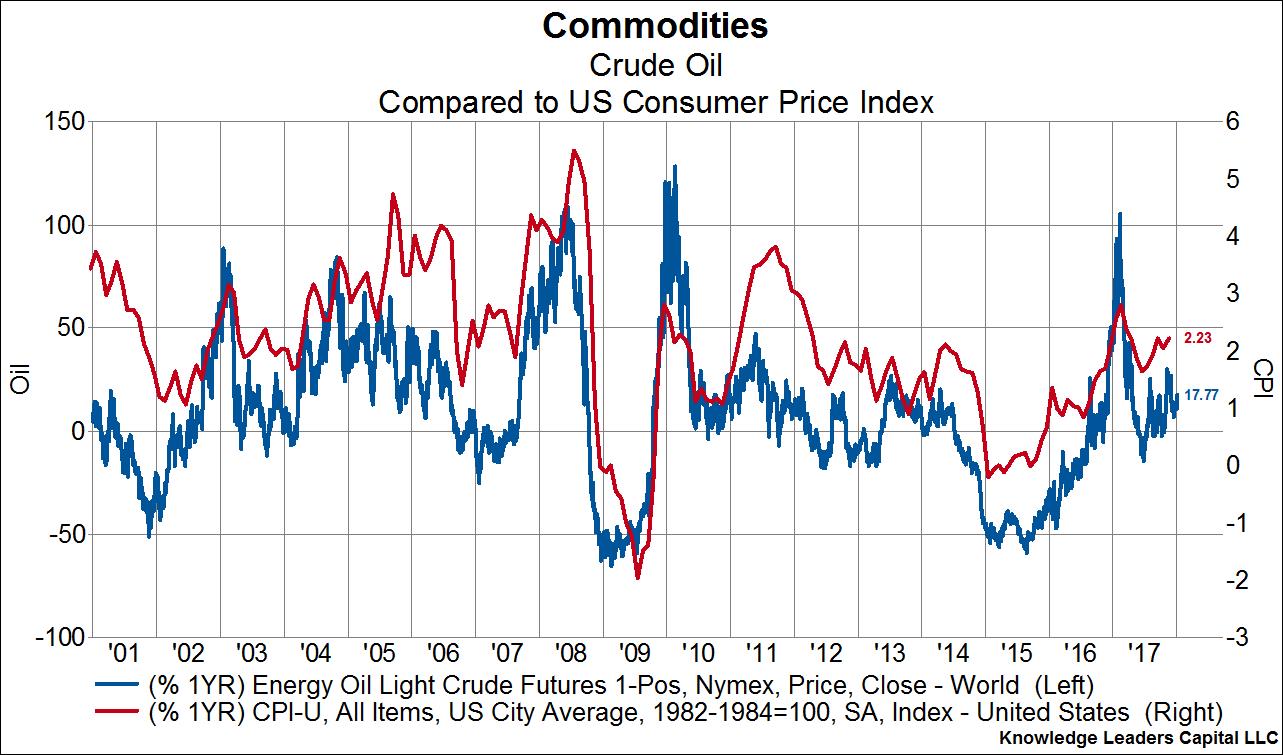

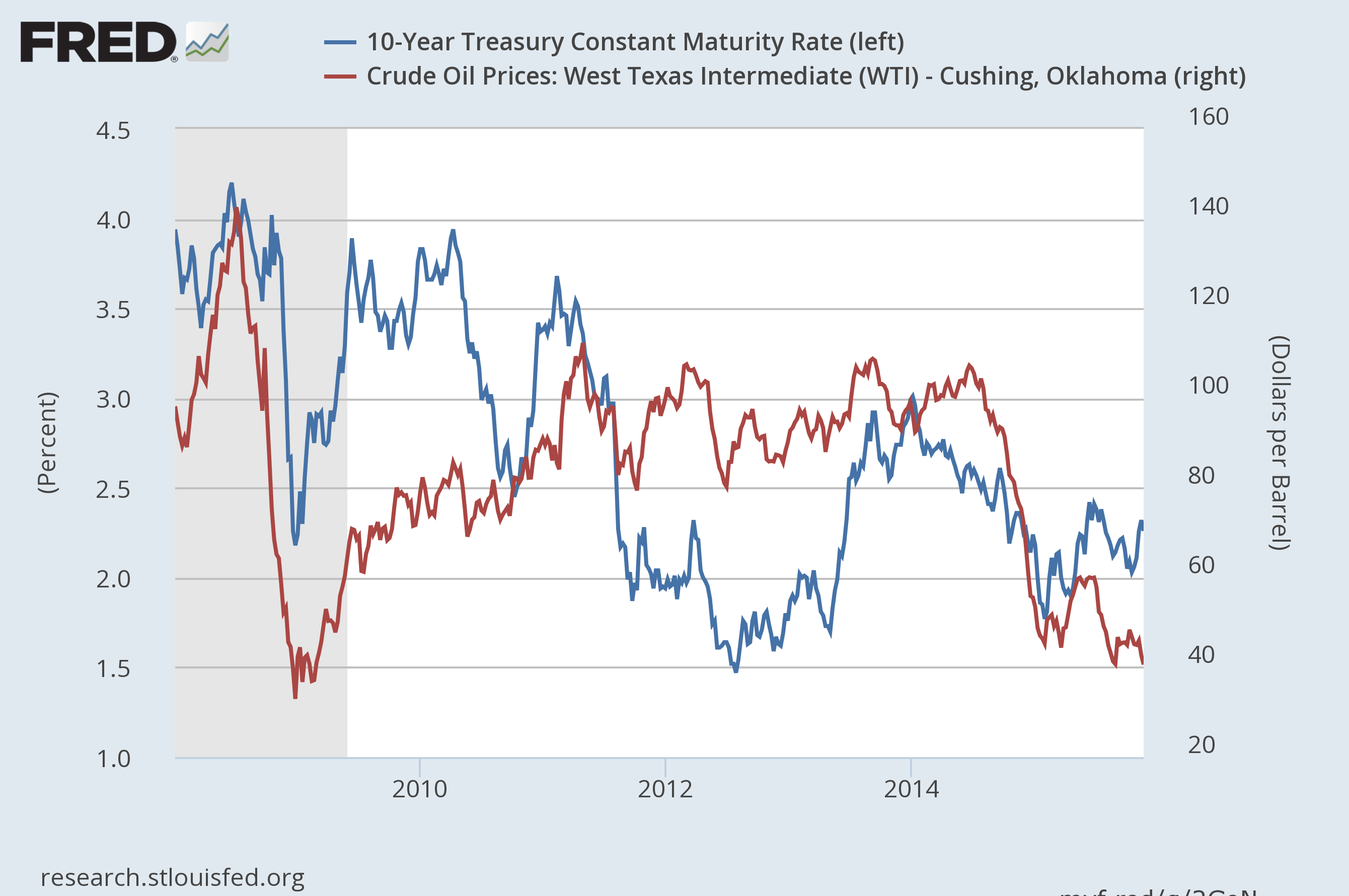

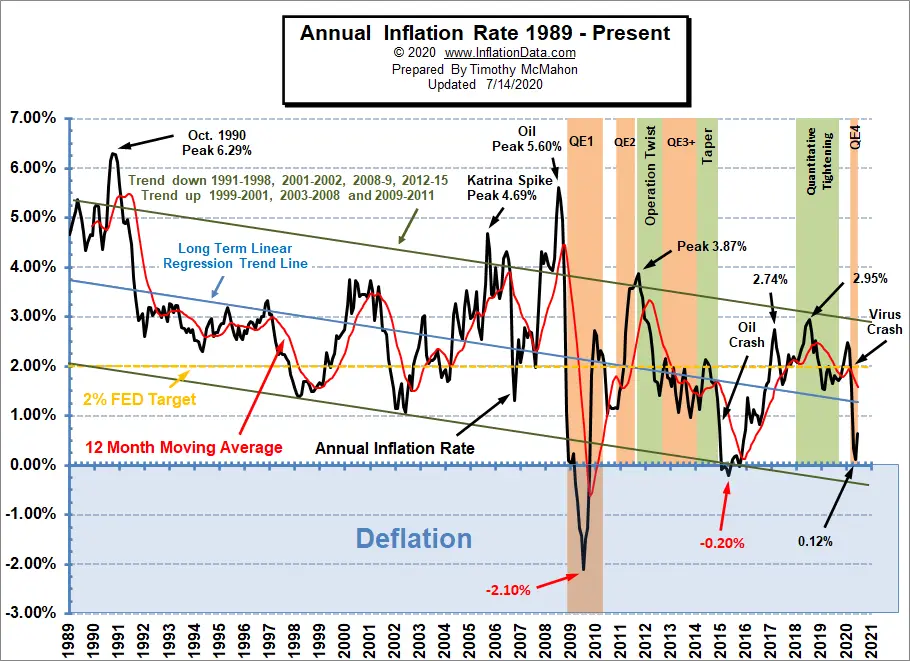

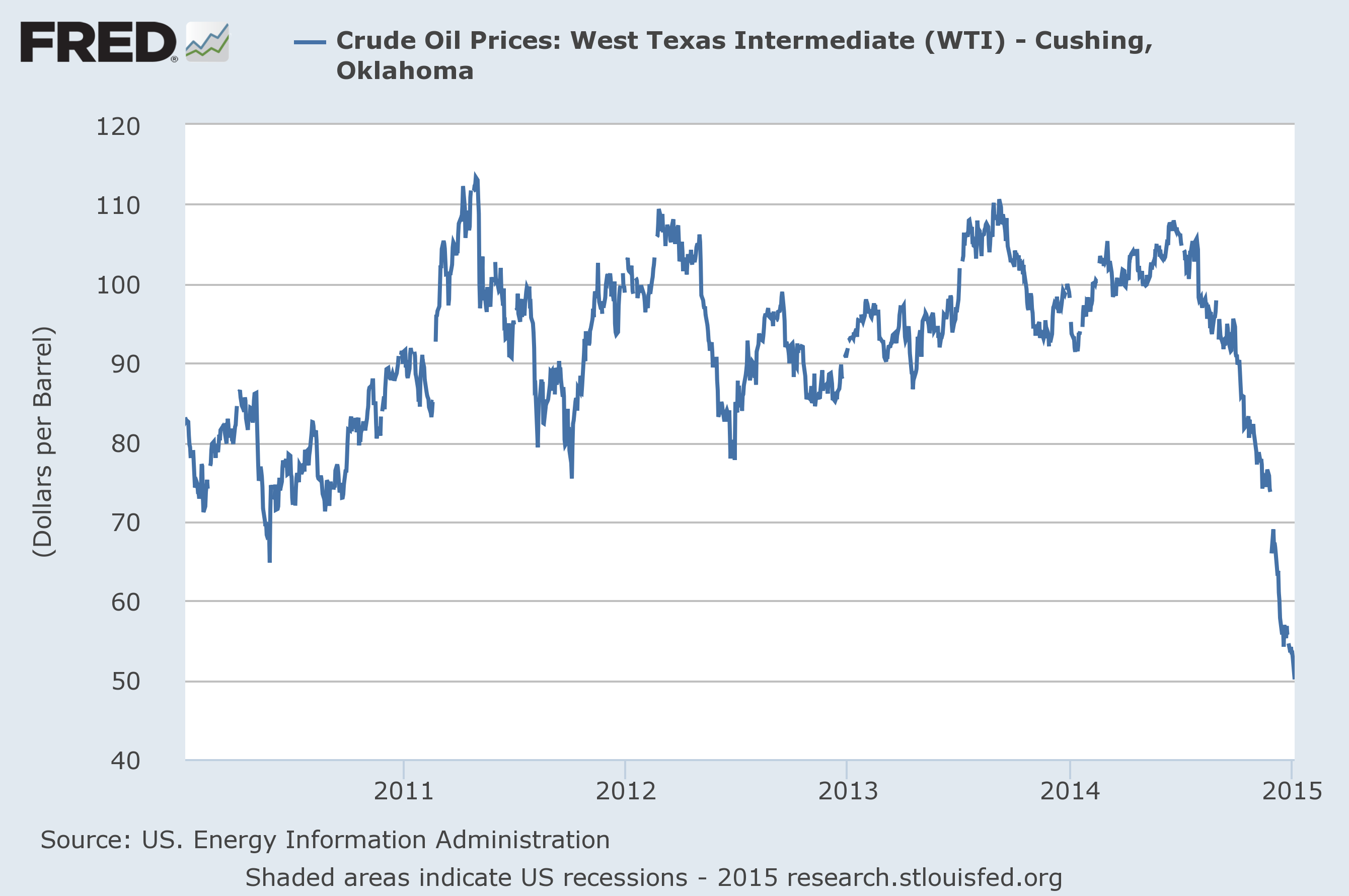

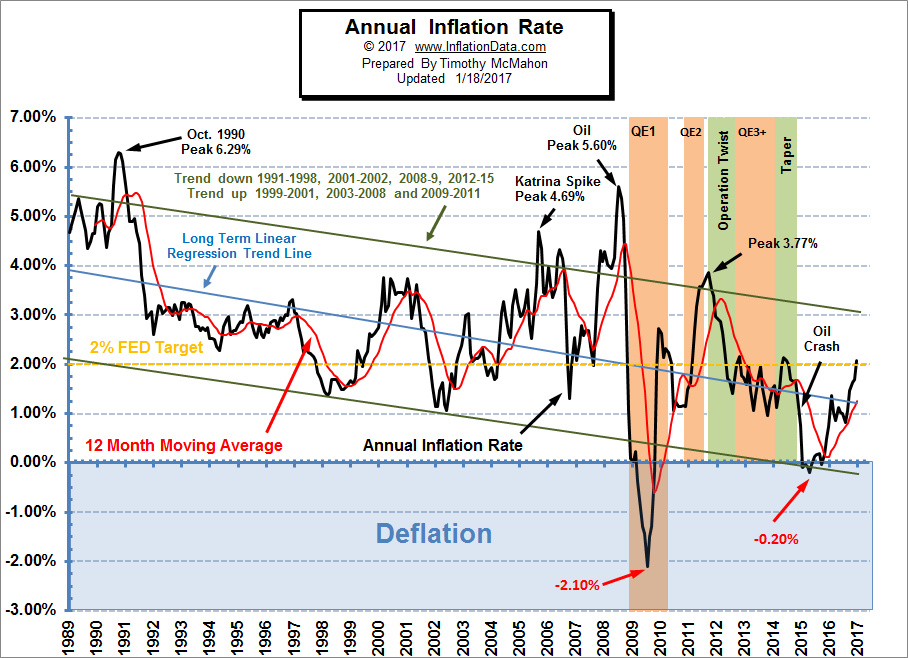

Interest Rates Vs Oil Prices Chart. The data is sourced from the ministry of economic development weekly series for petroleum products. If interest rates spike, suddenly goods that are bought with credit (such as automobiles, homes, and new factories) become more expensive. Recession high interest rates lead to more defaults. The central bank raised inflation forecasts for 2021 to 0.6% (vs 0.5% in september) and for 2022 to 1% (vs 0.7% in september), amid higher prices for oil products as well as supply bottlenecks.

Commodity prices and exchange rates Econbrowser From econbrowser.com

Commodity prices and exchange rates Econbrowser From econbrowser.com

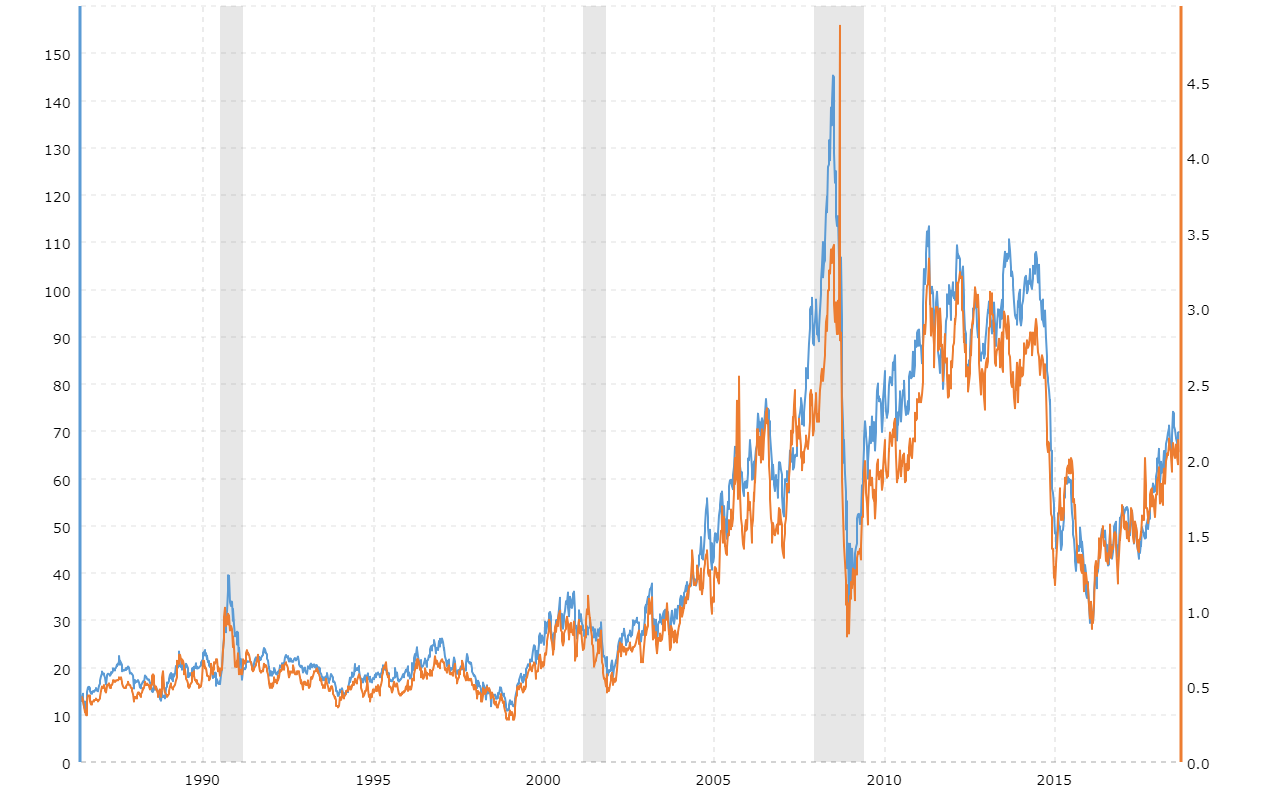

If interest rates spike, suddenly goods that are bought with credit (such as automobiles, homes, and new factories) become more expensive. Canada produces a high volume of oil and sells it near brent crude pricing. All of this underscores the correlation between interest rates and gold. These charts follow the weekly prices for crude oil, new zealand pump prices for unleaded 91 petrol and automotive diesel, as well as the amount of the retail petrol price that is tax, and the oil company margin. There is a historical inverse relationship between commodity prices and interest rates. Higher interest rates may mean lower stock prices, and lower interest rates may bring on higher stock prices.

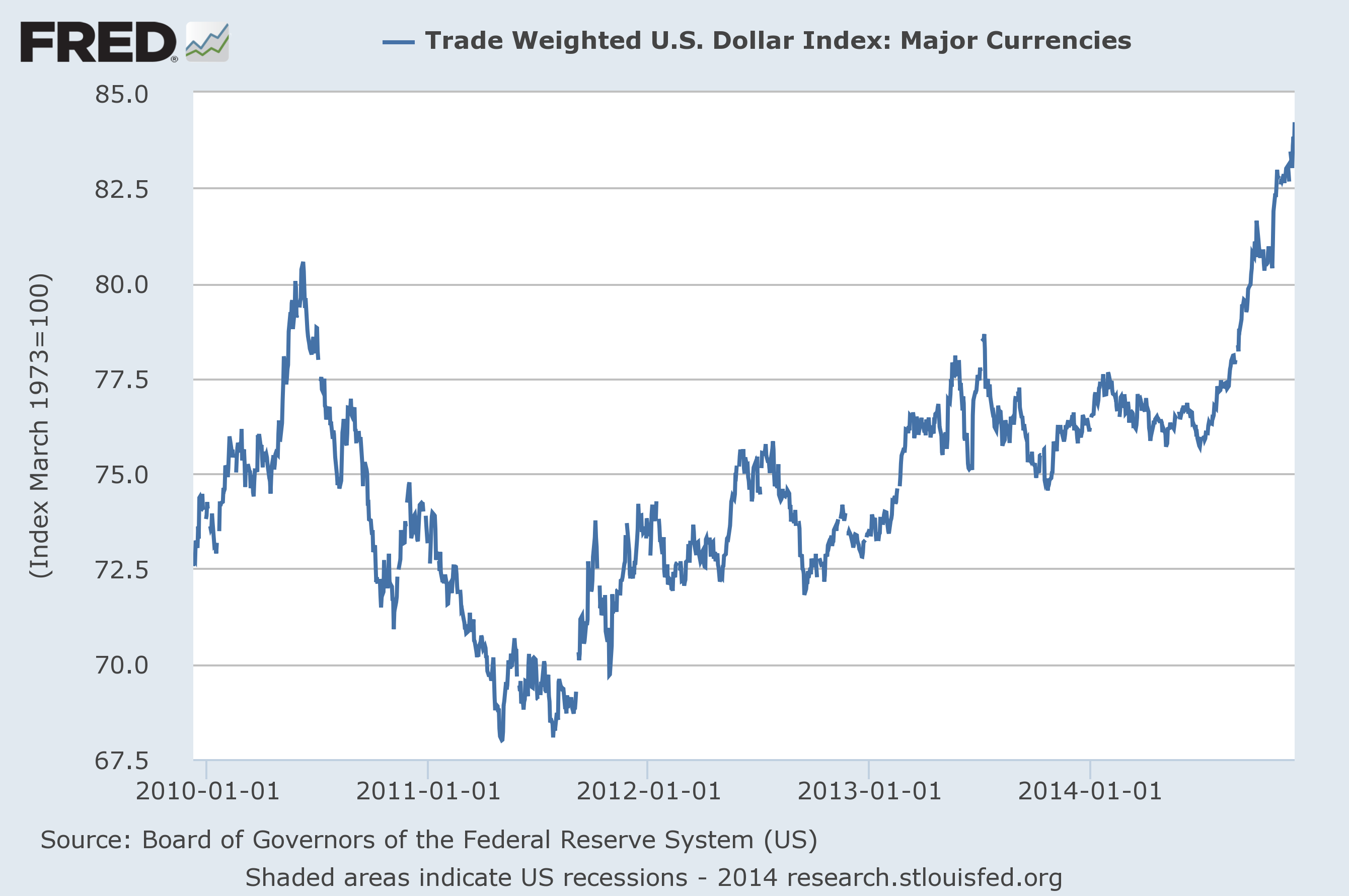

The us$ index (black) has risen 12% since may against other major currencies (euro, yen, […]

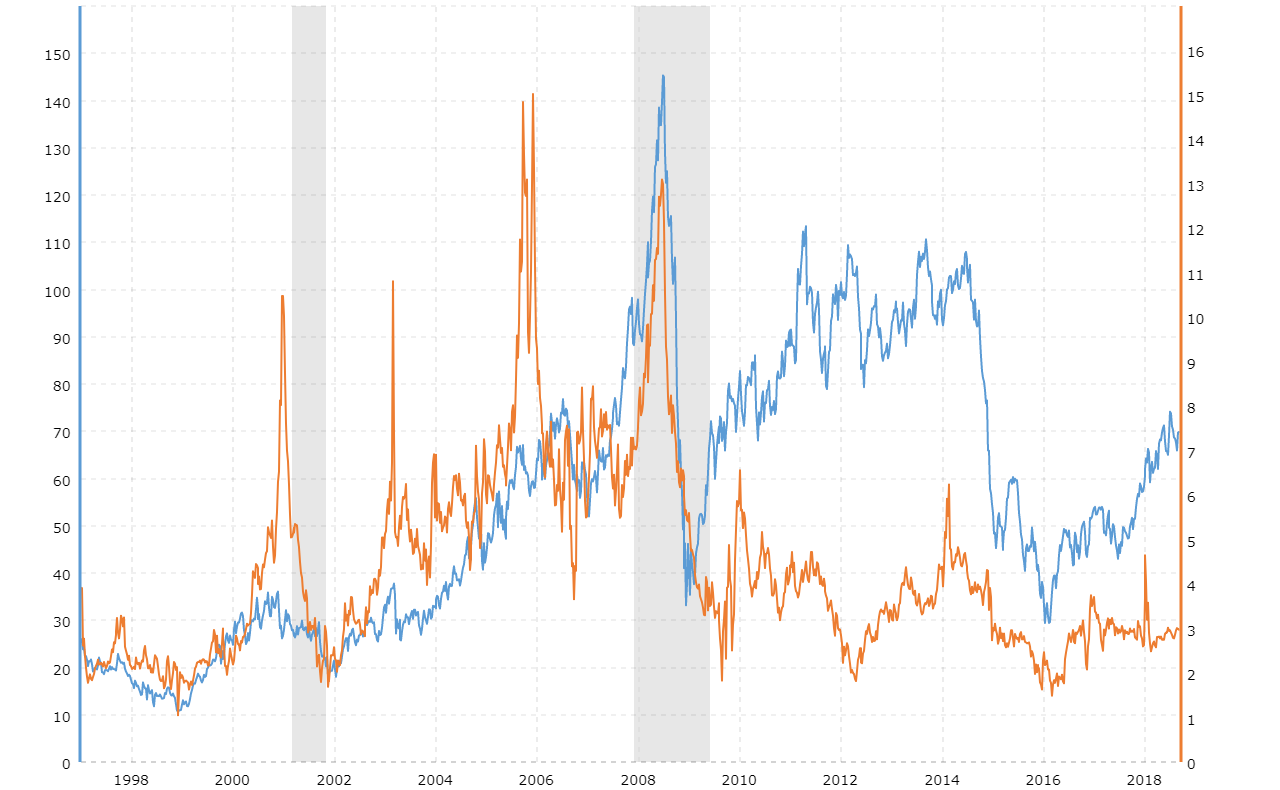

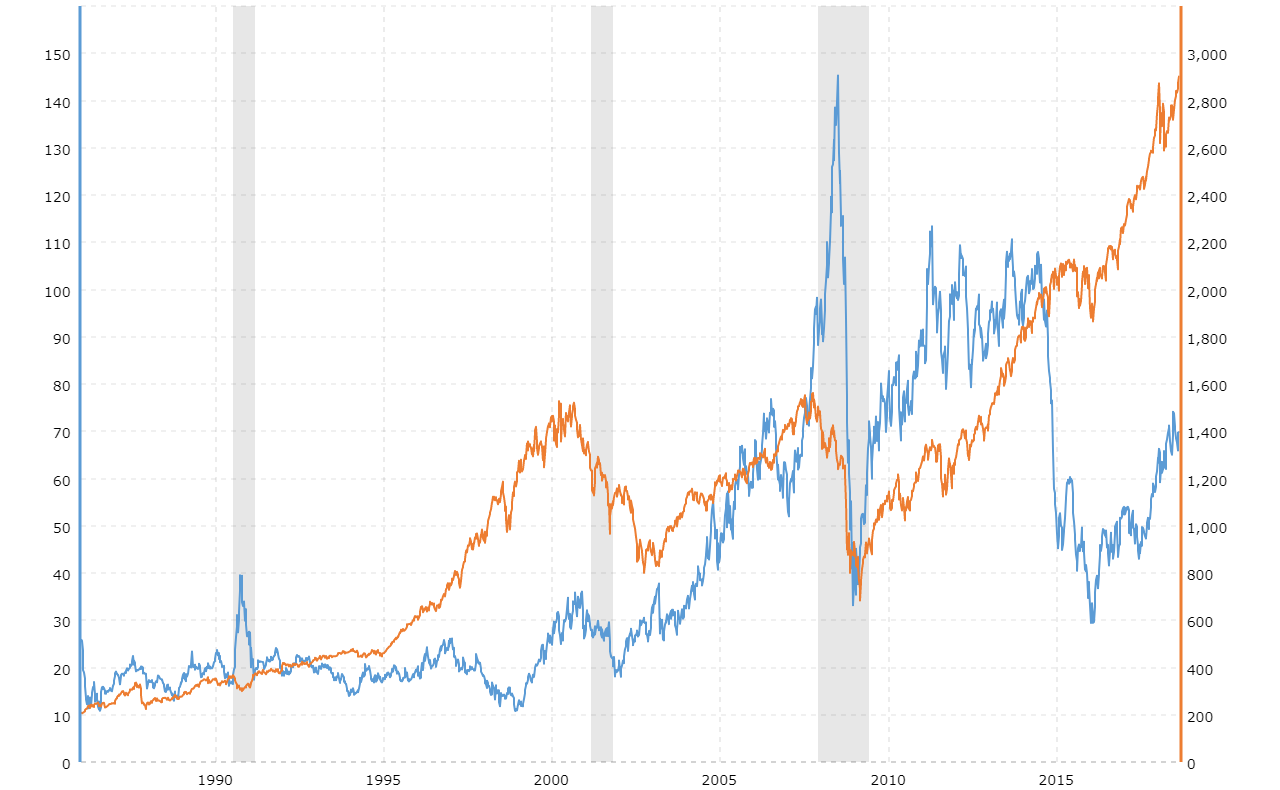

The data is sourced from the ministry of economic development weekly series for petroleum products. The data is sourced from the ministry of economic development weekly series for petroleum products. Interest rate in pakistan averaged 11 percent from 1992 until 2021, reaching an all time high of 19.50 percent in october of 1996 and a record low of 5.75 percent in may of 2016. Crude oil vs s&p 500. Condensed interest rates tables provide recent historical interest rates in each category. Interest rate in australia averaged 3.93 percent from 1990 until 2022, reaching an all time high of 17.50 percent in january of 1990 and a record low of 0.10 percent in november of 2020.

Source: weforum.org

Source: weforum.org

These charts follow the weekly prices for crude oil, new zealand pump prices for unleaded 91 petrol and automotive diesel, as well as the amount of the retail petrol price that is tax, and the oil company margin. Oilprice.com, in cooperation with its partners, offers over 150 crude oil blends and indexes from all around the world, providing users with oil price charts, comparison tools. Over the last year, interest rates have dropped from 2.1% to 0.9%, a 65% decrease. Interest rate in australia averaged 3.93 percent from 1990 until 2022, reaching an all time high of 17.50 percent in january of 1990 and a record low of 0.10 percent in november of 2020. The reason that interest rates and raw material prices are so closely correlated is the cost of holding inventory.

Source: macrotrends.net

Source: macrotrends.net

The following chart shows the price difference between wti and brent. The reason that interest rates and raw material prices are so closely correlated is the cost of holding inventory. When interest rates move lower, commodities tend to rise in price. In this chart we show the inflation adjusted housing prices from 1970 through 2013. When interest rates move higher, the prices of commodities tend to move lower.

Source: blog.knowledgeleaderscapital.com

Source: blog.knowledgeleaderscapital.com

The reason that interest rates and raw material prices are so closely correlated is the cost of holding inventory. My recent papers on the subject use those variables, along with inventories, to determine commodity prices: As an additional resource, we also provide summaries and links to recent interest rate related news. Rates are now below 1945 levels—and well under 6.1%, the average u.s. ¤ by increasing the incentive for extraction today rather than tomorrow (think of the rates at which oil is pumped, gold mined, forests logged, or livestock.

Source: econbrowser.com

Source: econbrowser.com

Higher interest rates may mean lower stock prices, and lower interest rates may bring on higher stock prices. The gdp growth was revised higher to 3.5% for this year (vs 3% earlier). Recession high interest rates lead to more defaults. Oilprice.com, in cooperation with its partners, offers over 150 crude oil blends and indexes from all around the world, providing users with oil price charts, comparison tools. Interest rate over the last 58 years.

Source: macrotrends.net

Source: macrotrends.net

Meanwhile, fracking in the u.s. However, at the pump oil is paid for near wti. Recession high interest rates lead to more defaults. All of this underscores the correlation between interest rates and gold. If interest rates spike, suddenly goods that are bought with credit (such as automobiles, homes, and new factories) become more expensive.

Source: wattsupwiththat.com

Source: wattsupwiththat.com

This table lists the major interest rates for us treasury bills and shows how these rates have moved over the last 1, 3, 6, and 12 months. ¤ by increasing the incentive for extraction today rather than tomorrow (think of the rates at which oil is pumped, gold mined, forests logged, or livestock. In early april 2020, the price of gold was hovering around $1,675/oz., close to the high for 2020 so far. Interest rate in pakistan averaged 11 percent from 1992 until 2021, reaching an all time high of 19.50 percent in october of 1996 and a record low of 5.75 percent in may of 2016. Over the last year, interest rates have dropped from 2.1% to 0.9%, a 65% decrease.

Source: inflationdata.com

Source: inflationdata.com

High interest rates reduce the price of storable commodities through four channels: If interest rates spike, suddenly goods that are bought with credit (such as automobiles, homes, and new factories) become more expensive. As 2016′s chart of the year shows: Inflation, interest rates, stock market & the dollar. Condensed interest rates tables provide recent historical interest rates in each category.

Source: globaleconomicanalysis.blogspot.com

Source: globaleconomicanalysis.blogspot.com

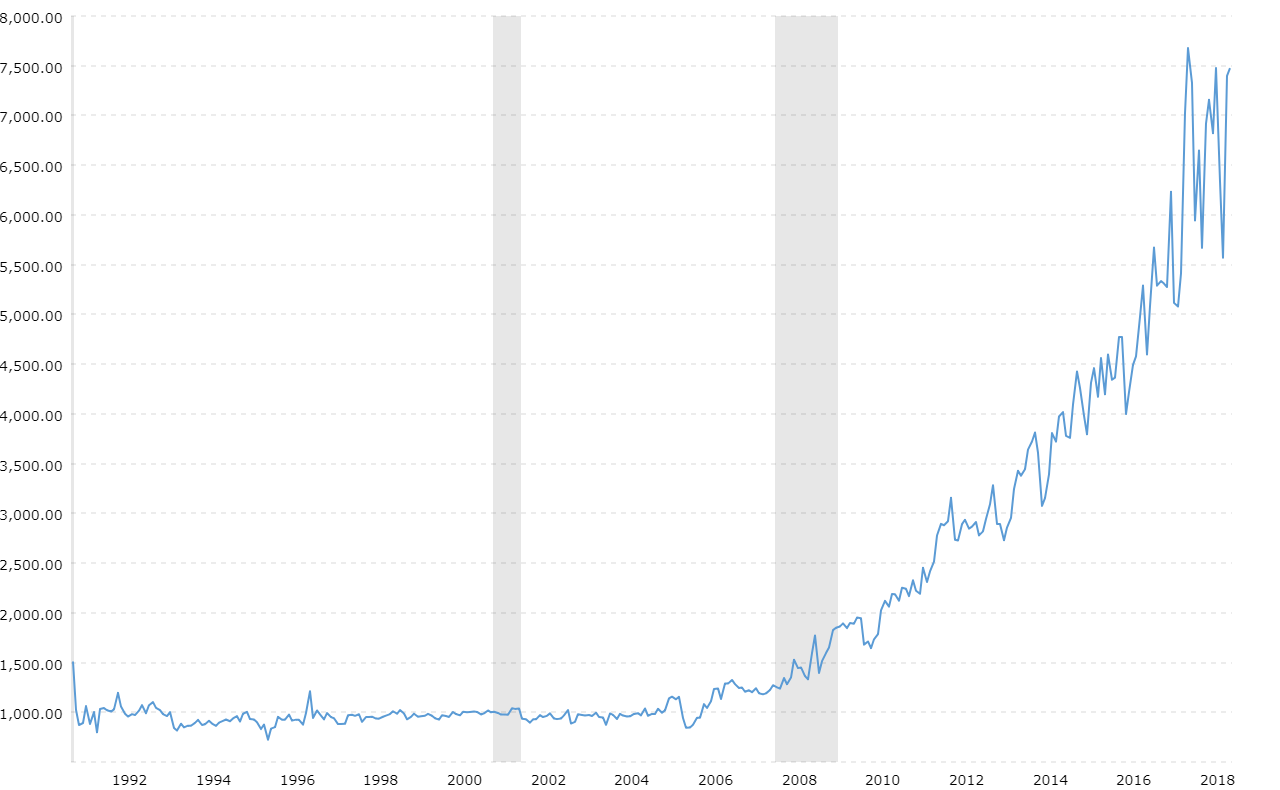

High interest rates reduce the price of storable commodities through four channels: As 2016′s chart of the year shows: Stock brokers are constantly touting. This interactive chart compares the price performance of west texas intermediate (wti) or nymex crude oil vs the henry hub natural gas spot price. Interest rate over the last 58 years.

Source: kelseywilliamsgold.com

Source: kelseywilliamsgold.com

It is likely to be less than $1/bbl in oil price impact, but that is not based on historical statistics.”. When interest rates move lower, commodities tend to rise in price. Inflation, interest rates, stock market & the dollar. ¤ by increasing the incentive for extraction today rather than tomorrow (think of the rates at which oil is pumped, gold mined, forests logged, or livestock. Canada produces a high volume of oil and sells it near brent crude pricing.

Source: artberman.com

Source: artberman.com

The world gold council notes that the fed rate cut should further support demand for gold among asset holders, even if consumer demand for gold declines. Interest rate over the last 58 years. Crude oil vs s&p 500. Rates are now below 1945 levels—and well under 6.1%, the average u.s. ¤ by increasing the incentive for extraction today rather than tomorrow (think of the rates at which oil is pumped, gold mined, forests logged, or livestock.

Source: macleans.ca

Source: macleans.ca

As 2016′s chart of the year shows: In recent years, oil prices and the s&p 500 have tended to move together, while oil prices have tended to move in the opposite direction of the dollar exchange rate and treasury bonds. Is showing new signs of life as the price of a barrel of oil rose at the end of last year. 100 year chart of the stock market, interest rates, home prices, inflation, the dollar. Meanwhile, fracking in the u.s.

Source: kelseywilliamsgold.com

Source: kelseywilliamsgold.com

For 2023, inflation forecasts were kept unchanged at 0.6%. When interest rates move higher, the prices of commodities tend to move lower. Meanwhile, fracking in the u.s. Stock brokers are constantly touting. This table lists the major interest rates for us treasury bills and shows how these rates have moved over the last 1, 3, 6, and 12 months.

Source: kelseywilliamsgold.com

Source: kelseywilliamsgold.com

There is a historical inverse relationship between commodity prices and interest rates. Over the last year, interest rates have dropped from 2.1% to 0.9%, a 65% decrease. How to analyze stocks based on interest rate decisions Oilprice.com, in cooperation with its partners, offers over 150 crude oil blends and indexes from all around the world, providing users with oil price charts, comparison tools. So, with oil prices now above $52 a.

Source: resilience.org

Source: resilience.org

If interest rates spike, suddenly goods that are bought with credit (such as automobiles, homes, and new factories) become more expensive. If interest rates spike, suddenly goods that are bought with credit (such as automobiles, homes, and new factories) become more expensive. ¤ by increasing the incentive for extraction today rather than tomorrow (think of the rates at which oil is pumped, gold mined, forests logged, or livestock. These charts follow the weekly prices for crude oil, new zealand pump prices for unleaded 91 petrol and automotive diesel, as well as the amount of the retail petrol price that is tax, and the oil company margin. The following chart shows the price difference between wti and brent.

Source: macrotrends.net

Source: macrotrends.net

Meanwhile, fracking in the u.s. Inflation, interest rates, stock market & the dollar. The gdp growth was revised higher to 3.5% for this year (vs 3% earlier). Higher interest rates may mean lower stock prices, and lower interest rates may bring on higher stock prices. Interest rate over the last 58 years.

Source: reddit.com

Source: reddit.com

The gdp growth was revised higher to 3.5% for this year (vs 3% earlier). Condensed interest rates tables provide recent historical interest rates in each category. This table lists the major interest rates for us treasury bills and shows how these rates have moved over the last 1, 3, 6, and 12 months. Graph and download economic data for from jul 1954 to feb 2022 about west, wti, intermediate, crude, oil, commodities, price, usa, federal, interest rate, interest. Last year it was the oil price fall.

Source: fintrend.com

Source: fintrend.com

Graph and download economic data for from jul 1954 to feb 2022 about west, wti, intermediate, crude, oil, commodities, price, usa, federal, interest rate, interest. During the 40 years from 1971 to 2011 housing prices appreciated an average of 4.81% a year, and interest rates averaged 8.85%. Last year it was the oil price fall. In early april 2020, the price of gold was hovering around $1,675/oz., close to the high for 2020 so far. How to analyze stocks based on interest rate decisions

Source: macrotrends.net

Source: macrotrends.net

When interest rates move lower, commodities tend to rise in price. Canada produces a high volume of oil and sells it near brent crude pricing. When interest rates move lower, commodities tend to rise in price. It is likely to be less than $1/bbl in oil price impact, but that is not based on historical statistics.”. ¤ by increasing the incentive for extraction today rather than tomorrow (think of the rates at which oil is pumped, gold mined, forests logged, or livestock.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title interest rates vs oil prices chart by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Man city vs man united player stats information

- Oil prices graph 2021 information

- Tottenham vs everton man of the match information

- Manchester city vs manchester united match today information

- International womens day 2022 facts information

- Iowa state basketball player xavier foster information

- Calvin ridley rookie year information

- Outlander season 6 hulu information

- Why is zion oil stock falling information

- Big ten basketball tournament printable bracket information